Do you know that over 95% of small businesses fail within the first five years due to a lack of financial soundness? Managing financing effectively can be a daunting task for small businesses. Are you also facing the same issue? If yes, you have reached the right place.

Here, this post outlines some of the tried and tested strategies to manage your small business finances brilliantly. You can either choose one or go for a mix of two-three strategies at your convenience. So, without much ado, let’s dive into the details.

Pay Yourself – The golden rule is, to pay yourself for all your expenses. At least as much as you can. How can it help in boosting your business’s financial health? You will not be drowned in debt if your business doesn’t pick up. This simple tip will ensure that your personal and business finances stay in good shape.

Invest in Growth – Small businesses should constantly look for innovation and growth. So, besides taking care of your expenses, set aside some funds and invest them in the right growth opportunities. It is a great way to hit a bull’s eye and maintain the good financial health of the business. Moreover, if your business is facing a hard time lately, here are some steps to take when your small business is struggling.

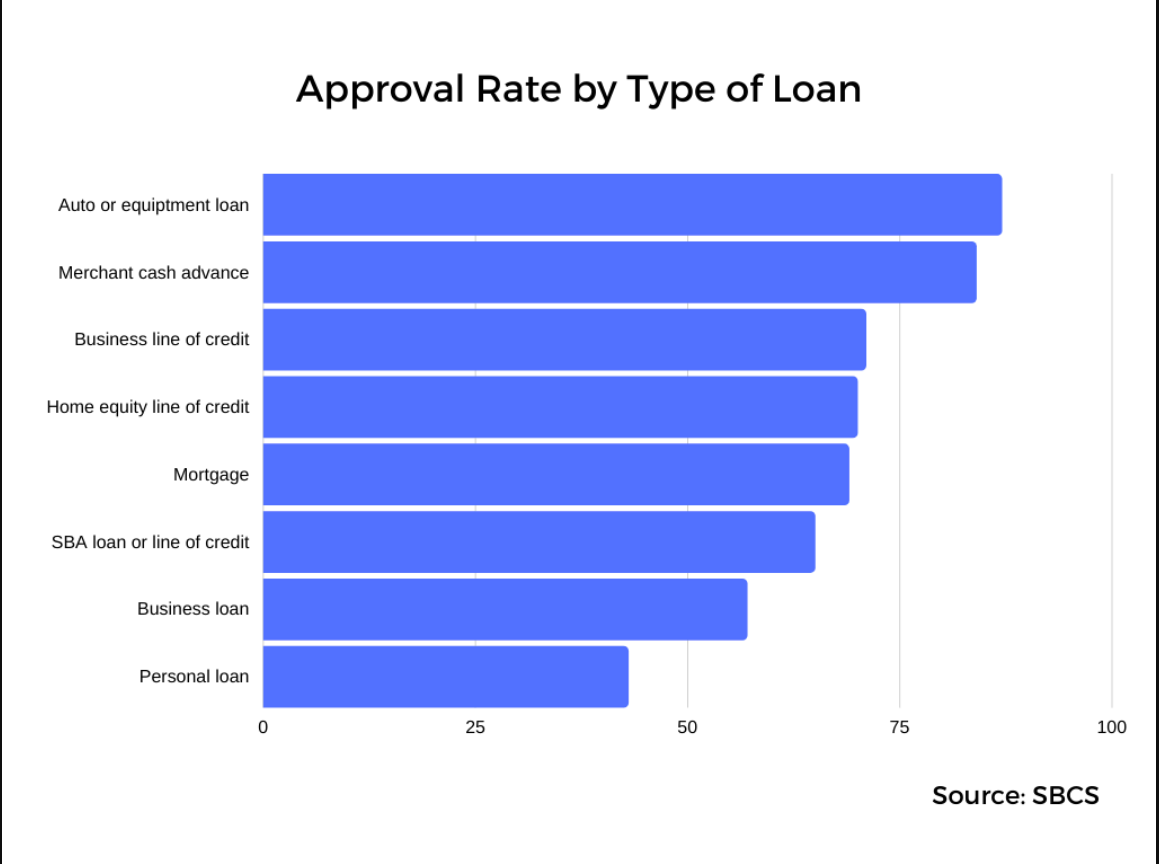

Don’t be Afraid of Loans – Do you know that around 77% of small businesses use their earnings for funding? You can also go for it, provided you are making that much. But if not, then a business loan is the only option you are left with.

Loans can lead to worries, especially for small businesses. But without financial assistance, they can have serious bottlenecks in their growth strategies. However, they should focus on repaying loans at the earliest.

Maintain a Good Business Credit – As your small business grows, you may consider investing more in commercial real estate, acquiring insurance policies, and much more. But with poor business credit, getting sanctions for these acquisitions and transactions can be a difficult task.

So, make sure you maintain good business credit. How can you do that? By paying your business credit card bills and loan installments on time.

Have an Effective Billing Strategy – Business owners often face a hard time dealing with clients who are consistently late in their payments. If not handled wisely, it can lead to a major financial crunch.

To overcome this issue, you should consider formulating effective billing strategies. For instance, you can offer a discount on the total bill for a client who pays before the deadline. It is a great way to manage your cash flows and maintain good business financial health.

Bottom Line

In a nutshell, maintaining a good business’s financial health is not rocket science, provided you know the secrets to growing your small business quickly. So, the best way to manage your business finances, plan ahead, pay yourself, focus on your ROI, and maintain good business credit.