Inflation is affecting most small businesses a lot right now. The U.S. Chamber of Commerce and MetLife researched and found that 85% of small business entrepreneurs expressed their concern about the inflation problem. In reality, small businesses need to prepare for Inflation as it always happens. However, it is vital to learn how Inflation impacts small businesses. So, let us get started on inflation concerns for small businesses.

What is Inflation?

Inflation concerns for small business measure the continuous increase in the price of services and goods over a set period. As their cost goes up, consumers start purchasing less. Many consider Inflation a bad thing, but it is always happening. Moreover, the Federal Reserve aims for a 2% inflation rate every year because if it is low, it will weaken the economy. However, it becomes a financial burden for customers and companies when it goes high.

How Does Inflation Impact Small Businesses?

Since the COVID pandemic began, small businesses are struggling to cope with increasing inflation costs. COVID-19 fast-tracked the ongoing supply chain issues and made it difficult to access goods. As a result, it drove up the prices. Here are some ways small businesses get impacted by Inflation:

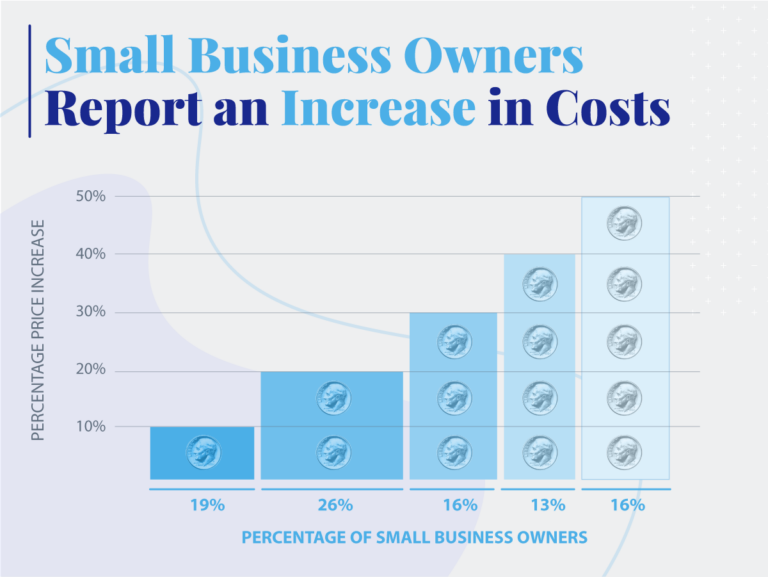

- Higher Costs: Most small companies have dealt with increasing costs since the start of the pandemic. The services and supplies you need for your business are more expensive now,

- Rising Prices: Running a small business is more expensive. Thus, most small-business owners have raised their prices to counter Inflation. However, it can be risky as some customers may not accept the higher price points.

- Cutting Overhead Expenses: Apart from increasing prices, cutting overhead expenses can be a good way to tackle inflation issues. Many owners have been forced to lower their inventory and marketing costs and look for better ways to save money.

- Tighter Profit Margins: Increasing prices often leads to tighter profit margins. It makes it difficult for small businesses to reach their margins and gains over time.

Tips on Dealing with Inflation

the inflation concerns for small business keeps on coming; it never ends. It is because the value you get is constantly changing. However, current Inflation will level off at some point. But until it happens, small businesses need to determine an effective way to manage the inflation impact. First, owners must decide whether to focus on business growth or stay small.

Small businesses have two choices: first, stay lean and mean, and second focus on growth. At this point, it isn’t easy to manage between these two options. If you want to stay small, focus on keeping the expenses low. Cut down all non-essentials and look for better ways to lower production costs.

The money you save will be good for your cash flow. You can determine ways to spend more time in marketing to the current customers to improve sales. But saving money is not everything. You need to focus on investing money and multiplying it.

When Will Inflation end?

In reality, inflation concerns for small businesses never stop. Therefore, the best thing is to decide how you will manage this situation in the small business. However, the answer depends on your priorities as an owner.