A Thrift Savings Plan or TSP is a retirement investment program for federal employees that’s quite similar to the 401 (k) plan of the private sector. Both of these plans have similar tax benefits and minimum retirement withdrawals, but the latter is just limited to private employees.

It certainly works as an effective approach for federal employees to save money for their retirement. That’s why millions of participants are associated with the Thrift Saving Plan presently.

TSP also offers various benefits to federal government workers. Besides the effects of the latest vaccine guidelines, you, as a federal employee, must also know everything about TSP. Read this guide to know it all:

What Does TSP Depend On?

TSP is a contribution plan, which means it depends on the money you add to your TSP account when you are working as a federal employee. Once you retire from your post, you’ll get funds that are collected throughout your working years. Not just that, if you go for a TSP, you can stay assured of reduced tax payment and its influence on your net pay.

How Does a TSP Work?

TSP and 401(k) plans work more or less the same. To make your contributions, you must be a full-time or part-time federal employee, and you must also be under pay status.

There are multiple ways by which you can invest in a TSP plan. You can do it through traditional/pre-tax accounts, Roth/after-tax accounts, or you can try both.

If you are a federal government employee who started working after October 1, 2020, the government will automatically enroll you in the traditional TSP plan. Not just that, about 5% of your income will be deducted and contributed to the TSP.

For this 5% auto-deduction, young employees contribute more to TSP than old ones. However, you can modify the contributions whenever you want.

Note that the contributions are dependent on the limit on elective deferrals. Currently (in 2023), the Internal Revenue Code elective deferral limit is $22,500. For the year 2022, the limit was $20,500. Similarly, for the years 2020 to 2021, it was $19,500. In 2019, the limit was $19,000.

As a federal employee under Federal Employees Retirement System, you’ll get the following:

- Agency Automatic Contribution ( about 1% of base salary)

- Agency Matching Contribution ( on the first 5% of the base salary)

TSP Loan

A benefit that all federal employees can get by contributing to TSP is a TSP loan. If you are a current federal employee, you can borrow funds from your TSP account as a loan. However, later you’ll have to repay the loan with interest through your payroll deductions. If you aren’t in federal service and still repaying your loan, you can pay the loan through direct debit, money order, or check.

You can take a TSP loan for either general or residential purposes. For general purposes, you can take a loan for anything. It doesn’t require documentation. Meanwhile, for residential purposes, you can take a loan to buy or build your own residence. In this case, documentation is required.

The repayment terms for both loans are different. For general purposes, you must repay the loan within 1-5 years. However, for residential purposes, you can repay the loan within 1-15 years. To get a TSP loan, you must meet the loan eligibility criteria as well. Make sure to read through the maximum loan amount that you can borrow. The minimum loan amount that you can take is $1,000.

What Benefits Does a TSP Account Offer?

When it comes to benefits related to a TSP account, the list can be endless. However, here are the ones that you must know:

- It ensures automatic payroll deductions, which means the money for contributions will be cut from your total earnings automatically.

- You’ll get different investment options like individual funds, mutual funds, and designed lifecycle funds for better flexibility.

- In special circumstances, you can go for early withdrawal of your TSP while still being a federal employee.

- You can make traditional or pre-tax contributions with tax-deferred earnings on investments.

- If you meet the IRS criteria, you can get Roth or after-tax contributions along with no-tax earnings.

- Being an employee of the Federal Employees Retirement System (FERS), you’ll be eligible for agency or service contributions.

- The cost related to investment and administrative tasks will be much lower.

- In any unfortunate event of your demise, your spouse will get the death benefits.

- You’ll get multiple choices of tax treatments for the contributions. Besides that, you’ll also get various distribution options once you retire.

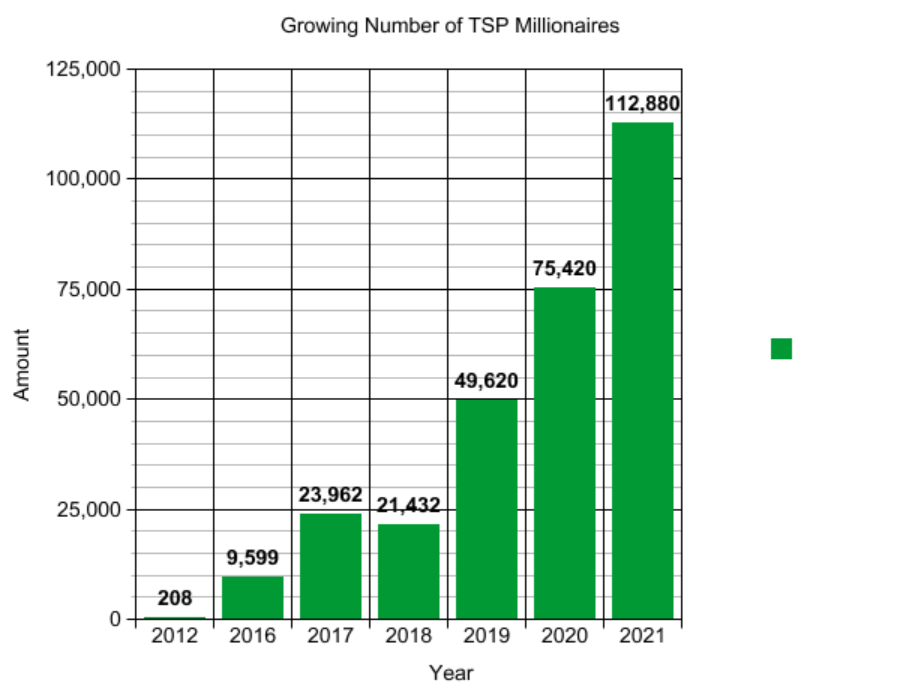

- The sooner you start with your monetary contribution, the higher your chances of becoming a TSP millionaire. That’s because higher funds will result in more value through compounding.

With your TSP funds, you can also roll over to ROBS (Rollover as Business Start-Ups) and start a small business. You can then invest the TSP money in different stages of small business growth.

Conclusion

So, to sum up, should you contribute to a TSP plan for your retirement? Absolutely! The benefits are never-ending. We hope now you know about all the benefits of thrift saving plans for federal government workers.