Size Standards Define the largest size business can have to participate in government contracting programs and compete for contracts reserved or set aside for small businesses. The size of the standards varies by industry and is generally based on the number of employees or the amount of annual receipts the company has received.

If you own a business, it’s essential to understand how big your business is. According to government agencies, different types of small enterprises have their procedures to follow. What is considered by the government to be a small business?

What constitutes a small business?

The answer to that question is not as simple as it sounds. When it comes to the standard of small business size, government agencies vary. The definition of small business for each agency determines your responsibilities and eligibility for small business benefits.

A small business may operate under any business structure. No matter if you own a sole proprietorship, a partnership, an LLC, or a corporation, you may be considered a small business.

The Small Business Administration (SBA), the Affordable Care Act (ACA), and the IRS each define what qualified as a small business. Take a look at the requirements below to see if you qualify as a small business.

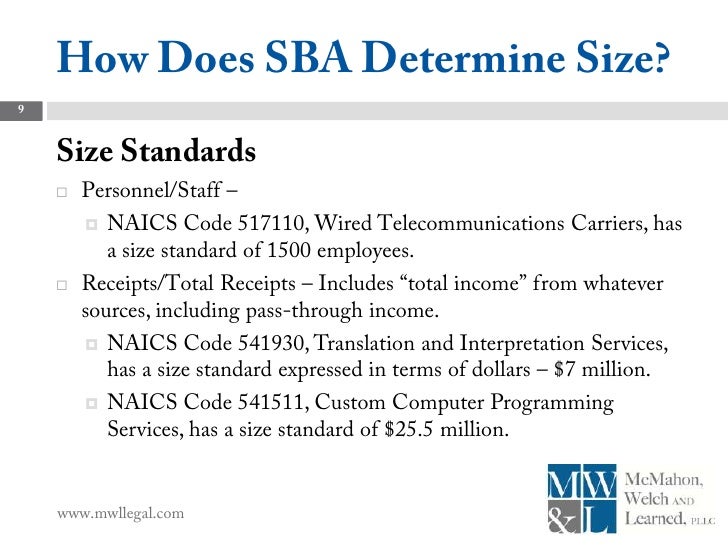

SBA size standards for small business

The SBA sets standards for small business sizes. If you qualify as a small business, you are eligible for benefits. According to the SBA, small businesses make up 99.7% of all U.S. employees.

There is no single metric for the SBA size standard. To determine if you are a small business, take a look at your industry, your annual sales and the number of employees.

For many companies, the standard classification of small enterprises by employees is 500 employees or less. But your industry could make a difference in your qualifications for size.

Typically, you must have between $750,000 and $35.5 million in sales and between or below 100 and 1500 employees. Use the U.S. Census Bureau industry code on the SBA website to see if you’re a small business.

You also need to comply with the following requirements:

- Headquartered in the U.S.

- Operate primarily in the U.S.

- For-profit venture

- Independently owned and operated (not owned by a parent corporation)

- A minority player in your industry (you don’t hold a major market share)

If you comply with the guidelines for small business SBA, you may be eligible for government aid. The SBA provides financial assistance and loan programs to small businesses that meet the SBA loan requirements. Small business owners have a better chance of securing an SBA guaranteed loan. The SBA guarantees part of the loan amount, which reduces the risk of the lender.

The Small Business Administration also provides advice to small businesses. And the SBA ensures that at least 23 percent of government contract work goes to small businesses.

Healthcare.gov (Affordable Care Act)

You can find the Healthcare.gov ACA small employer standards. Your business size sets out the laws that you must follow in relation to employee health coverage.

Unlike the SBA, Healthcare.gov sets a standard size for defining what is classified as a small business. If you have 50 employees or less, according to the ACA, you are considered a small company.

Employees may be full-time or full-time employees. The ACA defines a full-time equivalent employee as someone who works an average of 30 hours a week.

If you have part-time employees, you need to calculate full-time equivalent employees. Add to that the number of hours worked by part-time employees. Divide the total number of part-time employees you have. Add that figure to the total number of full-time employees. If the number is 50 or less, you’re a small business.

Why is the size of small businesses according to the ACA important? If you have 50 or fewer employees, you do not need to provide health coverage for employees. However, if you want, you can afford insurance. If you have 25 or fewer employees and offer a plan through the SHOP Marketplace, you may be eligible for a tax credit.

IRS Small Business Standards

The IRS does not have a standard size for small businesses. The size of your business depends on the specific tax legislation. Use IRS information to understand your company’s tax obligations.

The IRS provides an online resource to business owners who file Form 1040, Schedules C, E, F or Form 2106. The resource also applies to enterprises with assets under $10 million.

Take a look at the IRS Small Business and Self-Employment Tax Center to understand your small business responsibilities. You’ll find information on Business ID numbers, structures, and stages.

For an overview, check out our standard small business size table.

This blog was written by Linda Rawson, who is the founder of DynaGrace Enterprises (dynagrace.com) and the inventor of WeatherEgg (weatheregg.com). She, along with her daughter, Jennifer Remund make up the mother-daughter duo of 2BizChicks (2Bizchicks.com). For further information, please connect with Linda on LinkedIn, or contact her at (800) 676-0058 ext 101.

Please reach out to us at GovCon-Biz should you have any questions.