The balance sheet is a statement summarizing all the assets, liabilities, and equity of a company at a given time point. It is usually used to calculate a company’s liquidity for lenders, shareholders, and creditors. One of the reports listed in the financial statements of a company is the balance sheet. As of the end of the reporting period, the financial statements shall be included in the balance sheet, whereas the profit statement and cash flow statement shall cover the entire reporting period.

In order to better understand the company’s finances, small businesses must read out their balances at a particular time. You need to evaluate the reported assets, liabilities, and equity of your company to get a clear picture of what your business owns and owes on a single date to read a balance sheet.

How to Read a Balance Sheet

You need to know the various elements and what the published statistics tell you about your business’ health in order to read a balance sheet. Here is how a balance sheet can be read:

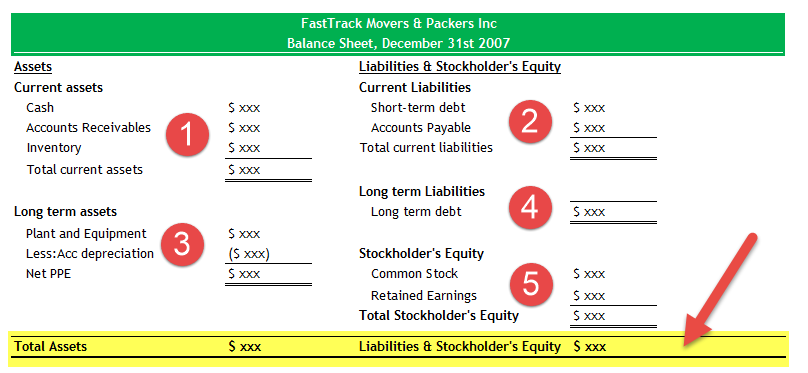

UNDERSTAND CURRENT ASSETS

Current assets are valuables held by your company, which will be transformed into cash within one year. Existing assets include the following:

- Receivable accounts: these are short-term payments due to your company, such as pending invoices that your buyers can eventually pay

- Inventory: for businesses selling physical products, inventory includes finished products, in-progress products, and raw materials

- Cash: includes checks, hard currency, and unregulated bank accounts.

ANALYZE NON-CURRENT ASSETS

Non-current assets are assets that you cannot convert into cash. There are both tangible and intangible assets for non-current assets.

- Tangible assets: include land, machinery, and equipment such as computers and printers

- Intangible assets: are non-physical assets, including goodwill, copyrights, and patents.

Most of the non-current assets listed on a balance sheet are depreciated, corresponding to the asset’s value over its useful lifetime.

EXAMINE LIABILITIES

Next, you’ll need to understand the liabilities of the company while reading a balance sheet. Liabilities are the financial obligations that the company owes to another entity. There are two types of liabilities:

- Current liabilities: short-term liabilities, including account payables, salary, and payments for long-term liabilities, has to pay in coming year.

- Long-term liabilities: these include mortgages, loans, and other financial obligations due in more than one year from the balance sheet date.

UNDERSTAND SHAREHOLDERS EQUITY

You will need to understand shareholder equity next on the balance sheet. The equity of shareholders means the total net value of a company. It contains the initial cash that an owner invests in the enterprise. If a corporation reinvests its net income in the business at year-end, its retained profit shall be listed on its investor equity balance sheet.

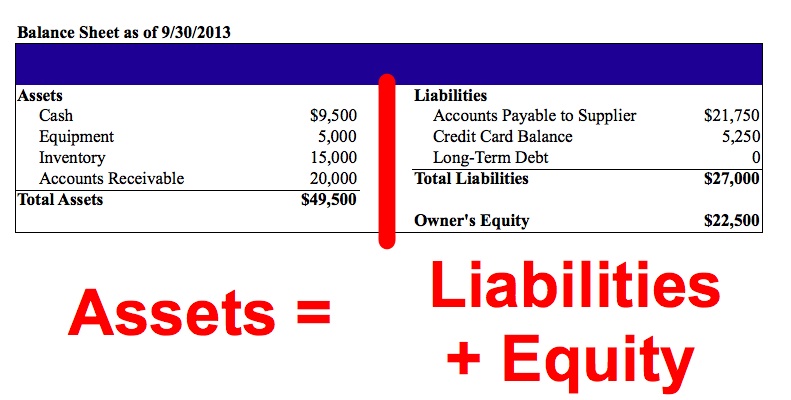

How Does a Balance Sheet Work?

There are two sections of Balance sheets; Here are the two:

- The business’s assets (debits)

- The business’s financial obligations (credits)

A balance sheet have two sides because it balances each other. You can use the main formula of a balance sheet to ensure that the two sides of your balance sheet are equal to each other:

Assets = Liabilities + Shareholder Equity

This blog was written by Linda Rawson, who is the founder of DynaGrace Enterprises (dynagrace.com) and the inventor of WeatherEgg (weatheregg.com). She, along with her daughter, Jennifer Remund make up the mother-daughter duo of 2BizChicks (2Bizchicks.com). For further information, please connect with Linda on LinkedIn, or contact her at (800) 676-0058 ext 101.

Please reach out to us at GovCon-Biz should you have any questions.